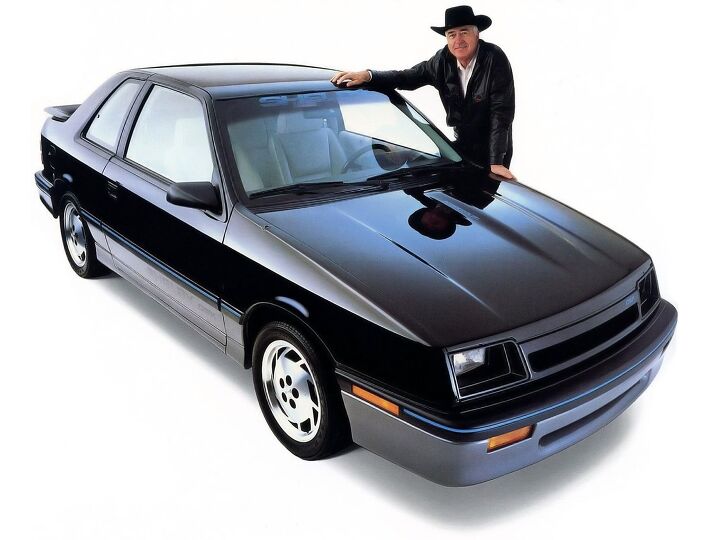

New Chrysler Morris IL: Experience the current stylishly and Efficiency

Wiki Article

Grasping the Art of Budgeting for Car Financing: Understanding Regular Monthly Repayments and Deposit

Browsing the realm of car financing requires an eager understanding of the complexities surrounding regular monthly repayments and down settlements. By very carefully dissecting the parts that make up monthly repayments and exploring the nuances of down payments, people can outfit themselves with the expertise required to make critical and informed selections when it comes to financing an auto.Regular Monthly Payments: Secret Considerations

When taking into consideration regular monthly settlements for automobile funding, it is crucial to thoroughly evaluate your budget plan and monetary commitments. Monthly repayments are a crucial element of auto financing as they straight impact your capital every month. To start, analyze your current income and costs to figure out just how much you can comfortably assign in the direction of an auto payment without straining your financial resources. It is advisable to aim for a month-to-month payment that disappears than 15% of your regular monthly net earnings to make sure price.Consider the funding term size and rate of interest price when assessing month-to-month payments. A shorter loan term may result in greater monthly repayments yet lower general passion costs, while a longer financing term could use extra manageable regular monthly settlements but at the cost of greater passion charges over time.

Deposit: Influence on Financing

Having actually developed the significance of thoroughly reviewing monthly payments in auto funding, the influence of down settlements on financing arrangements becomes an essential element to think about in figuring out the total price and terms of the financing. Down repayments are in advance settlements made at the time of acquiring a lorry and have a straight impact on the financing terms. On the various other hand, a smaller sized down repayment implies higher month-to-month repayments and potentially greater rate of interest rates, which can raise the overall expense of the vehicle over time.Budgeting Tips for Automobile Financing

Effective budgeting is essential for efficiently managing cars and truck financing and making certain financial security throughout the lending term. When budgeting for auto financing, beginning by calculating your regular monthly income and costs to establish just how much you can pleasantly allocate in the direction of a car repayment. It's crucial to think about not simply the monthly finance settlement but also extra prices like gas, insurance, and maintenance. Establishing a practical budget will aid you prevent economic strain and prospective default on settlements.An additional budgeting suggestion is to save for a deposit to reduce the total amount financed and potentially protect a far better rate of interest. Reducing back on unneeded costs and setting apart a certain quantity each month can aid you reach your deposit objective faster. Additionally, take into consideration the loan term carefully. cdjr finance in morris IL. While longer lending terms might decrease regular monthly payments, they usually result in paying a lot more in passion gradually. Choosing a much shorter finance term can her latest blog aid you reduce interest and repay the car earlier. By adhering to these budgeting ideas, you can much better handle your car financing sites and achieve financial tranquility of mind.

Working Out Methods for Better Terms

To enhance the terms of your automobile funding, it is vital to utilize critical settlement strategies that can result in a lot more beneficial problems for your car loan agreement. When bargaining for far better terms on your vehicle loan, prep work is crucial. Start by researching current passion prices, motivations, and promotions offered by different lenders. Having this details empowers you to bargain from a position of knowledge and strength.Another effective technique is to utilize pre-approved funding deals. By knowing what financing terms you get approved for ahead of time, you can utilize this as a benchmark during settlements with the dealer or lender (New chrysler Morris IL). Additionally, don't be reluctant to negotiate on all aspects of the finance agreement, including rate of interest, finance duration, and any type of added charges

Understanding Financing Terms and APR

A longer lending term might result in reduced monthly payments yet might lead to paying a lot more in passion over time. On the various other hand, a shorter finance term might suggest greater monthly repayments yet much less interest paid on the whole.

APR, or Interest Rate, represents the price of loaning, including passion and charges, shared as a percentage. A reduced APR suggests a better bargain as it implies reduced general prices for the finance (Used cdjr in Morris IL). Elements that influence APR include your credit rating, the finance amount, the lending term, and the lending institution's policies

When comparing car loan deals, focus on both the lending terms and APR to recognize the overall price of borrowing. A clear understanding of these variables will certainly encourage you to choose a cars and truck financing option that aligns with your budget plan and economic objectives.

Conclusion

In final thought, mastering the art of budgeting for auto financing needs mindful consideration of regular monthly settlements, down repayments, and car loan terms. By understanding these crucial variables and implementing budgeting ideas and negotiating methods, individuals can safeguard better financing terms and handle their expenses effectively. When buying a cars and truck., it is vital to assess lending terms and APR to ensure a clear understanding of the economic commitment and make notified choices.Browsing the realm of car financing requires a keen understanding of the intricacies bordering regular monthly settlements and down settlements. By very carefully studying the elements that make up regular monthly payments and exploring the nuances of down repayments, individuals can furnish themselves with the knowledge required to make educated and tactical selections when it comes to financing an auto. A shorter financing term may result in greater monthly settlements however lower general interest costs, while a much longer her response lending term might use much more manageable month-to-month repayments but at the expenditure of higher passion costs over time.Having established the relevance of carefully reviewing month-to-month payments in vehicle financing, the impact of down settlements on financing arrangements ends up being an essential aspect to consider in figuring out the general affordability and terms of the financing.In final thought, mastering the art of budgeting for cars and truck financing needs mindful factor to consider of month-to-month payments, down payments, and car loan terms.

Report this wiki page